How to dissolve a Company in Panama

Panama International Business Company

The dissolution of a company in Panama is a simple procedure that for proper implementation requires the execution of a set of guidelines established by the Law 32 of Public Limited Companies.

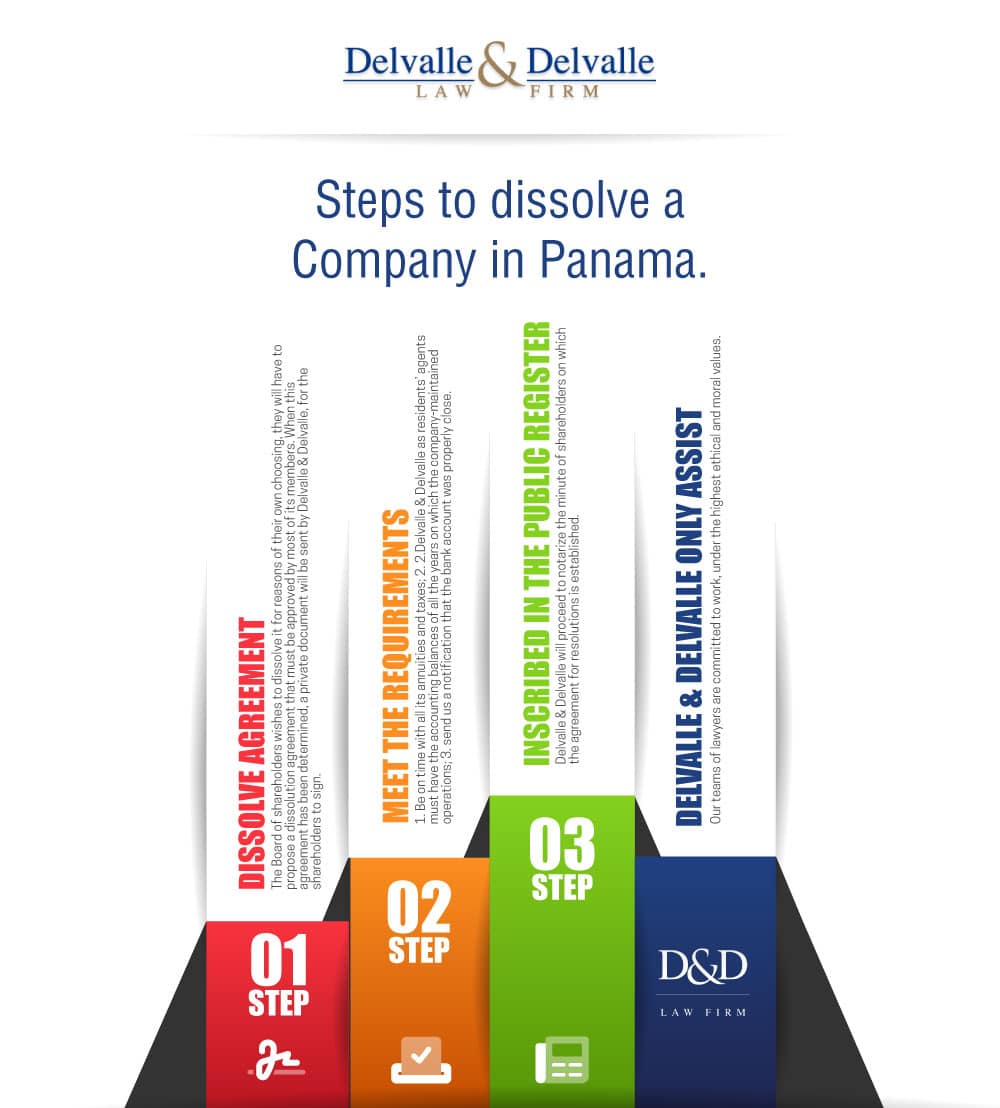

When the Board of shareholders wishes to dissolve it for reasons of their own choosing, they will have to propose a dissolution agreement that must be approved by most of its members. When this agreement has been determined, a private document will be sent by Delvalle & Delvalle, for the shareholders to sign. This document must be sent by email to us, duly signed.

In order to dissolve the company, the following requirements must be fulfilled:

- I must be on time with all its annuities and taxes (in case it applies) with the Panamanian Government.

- Delvalle & Delvalle as residents’ agents must have the accounting balances of all the years on which the company-maintained operations. If these 2 requirements are not fulfilled, then the dissolution won’t be inscribed.

- In case the company-maintained bank account before the dissolution the client must send us a notification that the bank account was properly closed.

Once all the requirements are done and the payment has been received, Delvalle & Delvalle will proceed to notarize the minute of shareholders on which the agreement for resolutions is established. This minute must be inscribed in the Public Register of Panama.

The registration of the document can take between 4-5 business days.

One is inscribed we will send a scanned copy to the client and the original by courier in the case is required.

When the company is dissolved it will no longer consider being active, and in case of any juridical proceedings or any kind of proceedings, must be applied what is stated on the articles o incorporation of such company.

Delvalle & Delvalle only assist in the proceeding of dissolution to those companies on which we are residents’ agents. Our teams of lawyers are committed to working, under the highest ethical and moral values.

For further assistance or questions please contact us.

Panama International Business Company

- General Information

- Characteristics

- Advantages

- Taxes

- Why Panama?

- Shelf Corporations in Panama

- FAQ's

- Plans and Additional Services

- Types of corporations in Panama

- Steps to incorporate an IBC

- Bearer and registered shares transfer

- How to dissolve a Company

- Resident Agent’s Functions and Requirements

- Amendment of the article of Companies in Panama

- Companies in Panama and Stock Capital

- Aspects of Law 32

- More information about IBC Companies

Please call us to +507-390-2890, use the chat system or the contact form below if you have any questions or requests concerning our services.

We will respond to your message within 24 hours.

Send us an Email